This is the fourth post in our series about what we call the Corporate Innovation ProblemTM and how to go about solving it. We started the series by spelling out the problems experienced by corporate innovation starting here. Despite large and growing investments into innovation, the results remain disappointing.

In this post, we show that firms are investing heavily into achieving excellence in the early phase of innovation, the so-called Fuzzy Front-End (FFE). These investments take different approaches from the systems that companies use to the physical assets.

Investing in FFE: Open Innovation

Studies show that over the past 10 years – with the exception of the financial crisis 2008/09 – investments into innovation have been steadily climbing. A significant part of the growing innovation / R&D investments went into open approaches to innovation.

15 years ago this meant intensifying research co-operation with universities, undertaking co-innovation with customers or other companies, bilaterally or multilaterally, within innovation clusters.

Then about 10 years ago, investments were made in using intermediaries such as NineSigma or InnoCentive in order to find ideas and experts for solving innovation challenges. Some companies built an “innovation challenge model” used by these intermediaries to create and invest in proprietary innovation networks, such as P&G’s “connect+develop” or Beiersdorf’s “Pearlfinder”.

More recently, investments have been made into approaches that discover innovation corridors beyond the normal innovation search fields. This is done by “systematic serendipity” with “unusual” co-innovation partners. Evonik, a German Euro16B Specialty Chemicals company, is widely seen to be the leader in this particular type of open, cross-industry innovation.

Investing into the FFE: Innovation Centers

More recently, a number of companies have invested into building listening posts or innovation centers in major hubs with the explicit mandate to discover and to drive significant innovation opportunities.

Usually, these innovation centers are aimed at gaining access to latest technologies and deeper understanding of customer needs by leveraging the hub’s ecosystem of other incumbents, startups, venture capitalists, accelerators, vendors, and academic institutions.

Capgemini has found that the number of corporate innovation centers now exceeds 300 and globally Silicon Valley, London, Paris, Singapore and Tokyo are the major hubs. One way of looking at the overall innovation process is that the FFE is about “the right innovation things” (effectiveness) whereas the innovation Efficient Back-End (EBE) is about executing “innovation things right” (efficiency and quality).

Investing into the FFE: Manufacturing Innovation Centers

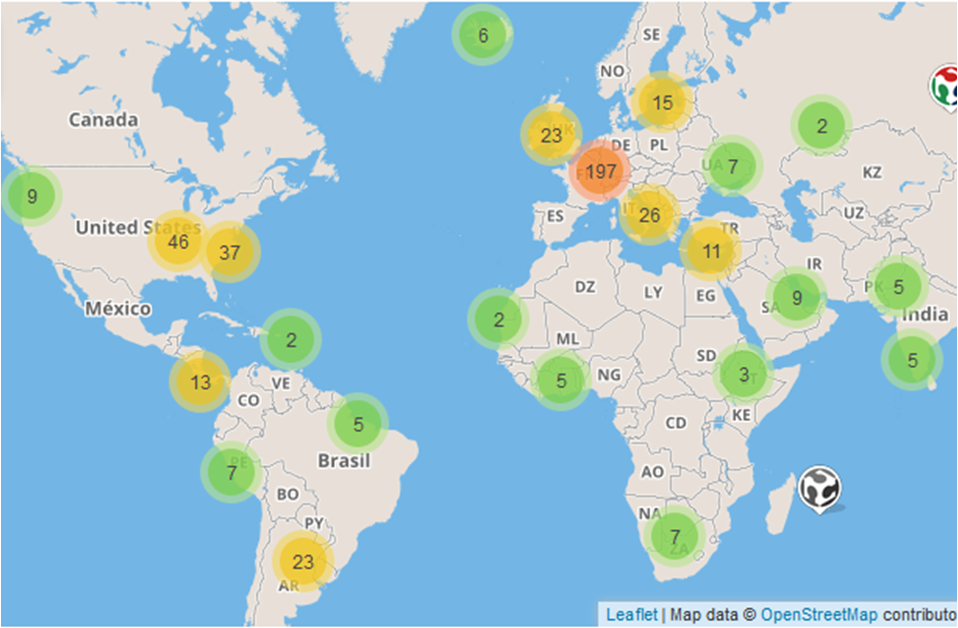

Companies are also investing in innovation centers that are geared towards manufacturing technology. Currently, there are more than 400 of these so-called “Fab Labs”, the majority of them being in Europe.

Global FabLab map (Source: Marc Giget, Club de Paris des Directeurs de l’Innovation)

One example of is Airbus’ Protospace. It provides Airbus and trusted partners with adaptive environments and tools that support the materialization of emerging, manufacturing-related concepts.

Protospace is designed in a way that a number of pathways to industrialization are possible. So for instance, a specialized component might be constructed collaboratively between Airbus and a partner using Protospace’s 3D-printing facilities but the industrialization is then done outside of Airbus by the partner.

In some instances, the boundaries between innovation centers and FabLabs are blurring. One example is General Electric’s Bielsko-Biala site which is an innovation center and a FabLab at the same time. There, customers and GE teams co-locate and co-innovate to undertake joint activities ranging from ideation, rapid prototyping, product development and building up technical capabilities to product certification.

Investing into the FFE: Corporate Venture Capital

Corporate Venture Capital (CVC) is usually used in one of two ways: Firstly, via direct cash investments, companies want to get access to emerging technologies and business models and/or obtain a mid-term bucket of strategic options. Secondly, by founding or participating in accelerators and incubators, companies want to be able to look into a broad array of search fields.

As Boston Consulting Group (BCG) has found recently, CVC – which makes up roughly 13% of all global Venture Capital – is being refocused, from a more financial-engineering focused objective to an innovation-outcomes objective.

Corporate Venture Capital: Rocket Fuel for innovation (Source: BCG)

While the combination of investment vehicle and search field differs significantly by industry, BCG found that across a number of industries the innovation center approach is surging ahead in importance. According to BCG, roughly one third of major companies is using CVC in this way.

Investing into the FFE: Innovation management systems

Investments into the FFE are also targeted at formalizing innovation management processes and deploying supporting IT systems.

Accenture recently found that 74 percent of large companies now have formal innovation processes – up by 12 percentage points since 2012 and that use of advanced IT tools has become widespread. So for example, systems for rapid prototyping, applications for social media analytics and ideation platforms are now present in 80 to 90 percent (depending on the category of tools) of large companies.

Implications

As we have already pointed out, there is no one-size-fits-it-all FFE – Companies need to built their own relevant to their business and market situation. In the past, a big majority of companies has invested into the “infrastructure” of the FFE. Some of these approaches might also be relevant for your company in its quest to find the optimal FFE.

About dual-innovation.net

dual-innovation.net is an international agency focused on solving the corporate innovation problem. To achieve this, we provide consulting services based on proven, best-in-class methodology which in many cases is proprietary. The services are delivered by experienced innovation management specialists and by subject-matter experts.

Please get in touch with us if you want to improve the outcomes of your innovation investments.